In the ever-evolving landscape of cryptocurrency mining, investing in ASIC miners is not a decision to be taken lightly. These specialized mining machines, tailored to solve complex hashing algorithms, have become the backbone of Bitcoin and other cryptocurrency networks. Their prices, however, can vary dramatically, influenced by several underlying factors that prospective buyers must understand to make informed decisions. From Bitcoin’s dominance in the mining ecosystem to the nuances of mining farm operations, grasping the intricacies of ASIC miner pricing is crucial.

The cornerstone of ASIC miner valuation lies in its hash rate— a measure of computational power. Higher hash rates mean more chances of solving blocks, and thus, more potential revenue. For example, a miner designed for Bitcoin (BTC) typically offers a much higher hash rate than one optimized for Ethereum (ETH) or Dogecoin (DOG), mainly due to Bitcoin’s SHA-256 algorithm requiring specialized hardware. As network difficulty adjusts with the increasing number of miners, the value of your machine’s efficiency becomes paramount. If you buy a miner with outdated specs at an inflated price, the return on investment dwindles swiftly.

Another critical factor shaping ASIC miner prices is the energy consumption of the hardware. Mining rigs demand massive electrical input, and energy cost often dictates mining profitability. Miners boasting low power consumption per terahash (TH/s) are prized assets because they reduce operating costs substantially. Emerging variations of ASIC rigs now integrate cutting-edge cooling technologies to mitigate heat production, further preserving hardware integrity and amplifying lifespan.

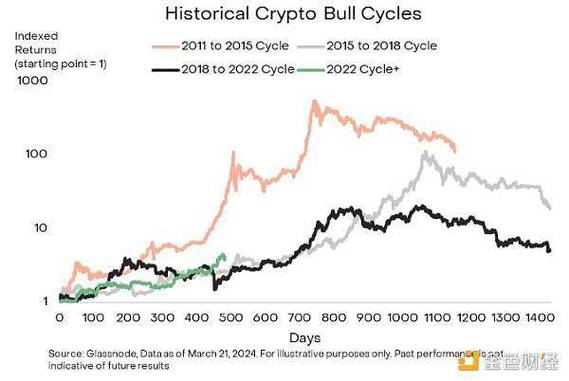

Cryptocurrency volatility also plays a shadow game in the background, influencing ASIC miner prices indirectly. When Bitcoin or Ethereum prices surge, demand for mining machines spikes, often causing price hikes for new and even used devices. Conversely, during market slumps, miners might liquidate equipment at discounted rates to mitigate losses, providing opportunities for budget-conscious investors. However, timing is paramount; buying during a downturn could mean slower profitability but potentially greater gains once markets rebound.

Hosting services have sprung up as a compelling option for those unwilling or unable to manage physical mining rigs themselves. Mining machine hosting allows users to lease space in data centers that house these miners, handling electricity, cooling, and maintenance on their behalf. For example, a mining farm operator specializing in BTC hosting adjusts operational costs based on electricity tariffs and cooling architecture, impacting hosting fees. While hosting relieves the burden of technical upkeep, it adds an operational cost layer, affecting overall profitability. The balance between hosting convenience and cost-efficiency is a tightrope walk for investors evaluating ASIC miner acquisitions.

When delving deeper, the supply chain intricacies cannot be ignored. Global semiconductor shortages, customs delays, and geopolitical factors frequently impact ASIC machine availability and pricing. Manufacturers like Bitmain and MicroBT must navigate these hurdles, often passing costs to consumers. Additionally, competition among miners intensifies as new ASIC models with enhanced performance hit the market, sometimes rendering earlier models obsolete. This technological arms race makes timing purchases critical: buy too late, and your miner may struggle to keep pace with the network’s escalating difficulty and competitive landscape.

It’s impossible to ignore the multi-token dimension of mining, which extends beyond Bitcoin to cover coins like Dogecoin (Dog), Ethereum (ETH), and countless altcoins. While ASICs dominate for Bitcoin’s SHA-256 algorithm, Ethereum networks rely heavily on GPUs or specialized rigs like the Ethash ASICs. Dogecoin mining often overlaps with Litecoin’s Scrypt-based ASICs, showcasing the diversity in mining hardware. The expansion into multi-algorithm miners introduces an added complexity: investors must analyze which coin or combination of coins to target and how hardware aligns with those choices to maximize profitability and manage risk.

Beyond hardware and pricing, regulatory environments play an influential role. Regions with crypto-friendly policies attract miners and hosting farms, fostering competitive markets that can drive hardware prices either upward due to heightened demand or downward thanks to innovation and economies of scale. Conversely, jurisdictions imposing electricity restrictions or outright bans on mining can suppress demand locally, sometimes creating secondary markets for ASIC miners. Investors must stay abreast of these dynamic legal landscapes, as shifts can dramatically affect both price and the feasibility of continued mining operations.

Mining profitability calculators, which incorporate hash rate, electricity costs, mining difficulty, and current cryptocurrency prices, serve as invaluable tools. They can guide purchases by forecasting returns, but these projections are highly sensitive to fluctuations in any variable—reinforcing the inherent volatility of investing in ASIC miners. Successful miners often blend quantitative analysis with qualitative metrics like technological longevity, manufacturer support, and community feedback.

In conclusion, the pricing of ASIC miners is subject to a symphony of interlocking elements: technical specifications, energy consumption, market sentiment, geopolitical conditions, regulatory climates, and the burgeoning ecosystem of cryptocurrencies. Whether engaging in Bitcoin’s rigorous mining environment or exploring altcoin ventures, prospective investors must navigate a labyrinth of considerations before committing capital. Embracing this complexity allows one to not only grasp ASIC pricing paradigms but also seize strategic opportunities within the dazzling and dynamic crypto mining sphere.

Leave a Reply